All Categories

Featured

Table of Contents

The requirements also promote development and progress via extra investment. In spite of being recognized, all capitalists still need to perform their due diligence throughout the process of investing. 1031 Crowdfunding is a leading property financial investment platform for alternative investment cars largely offered to certified financiers. Accredited financiers can access our selection of vetted investment possibilities.

With over $1.1 billion in protections sold, the administration team at 1031 Crowdfunding has experience with a broad range of investment structures. To access our full offerings, register for a financier account.

Accredited's workplace culture has typically been We believe in leaning in to support boosting the lives of our coworkers in the exact same method we ask each various other to lean in to passionately sustain enhancing the lives of our customers and neighborhood. We give by supplying methods for our group to rest and re-energize.

Best Private Investments For Accredited Investors

We likewise provide to Our perfectly designated building includes a fitness area, Relax & Relaxation spaces, and modern technology made to support versatile work areas. Our finest ideas originate from working together with each various other, whether in the workplace or working remotely. Our proactive financial investments in technology have actually allowed us to develop an allowing staff to contribute any place they are.

If you have a passion and feel you would certainly be a great fit, we would like to link. Please make inquiries at.

Dynamic Tax-advantaged Investments For Accredited Investors

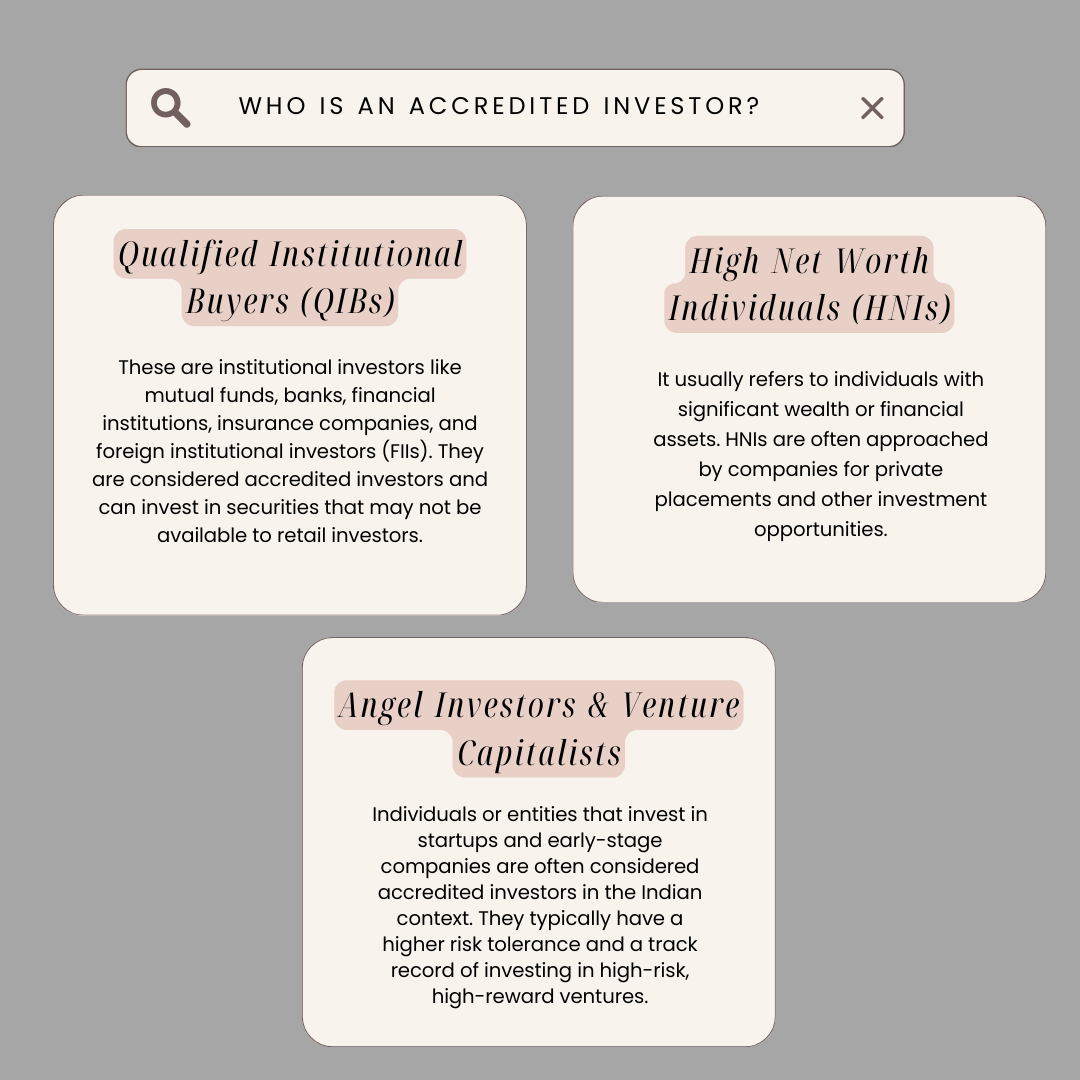

Certified financiers (sometimes called certified financiers) have access to financial investments that aren't readily available to the public. These financial investments could be hedge funds, hard money lendings, convertible investments, or any kind of other safety and security that isn't registered with the economic authorities. In this article, we're going to concentrate particularly on property financial investment choices for certified investors.

This is everything you require to recognize regarding realty spending for certified capitalists (crowdfunding sites for accredited investors). While any individual can buy well-regulated safety and securities like stocks, bonds, treasury notes, mutual funds, and so on, the SEC is concerned concerning average capitalists getting right into investments beyond their ways or understanding. Rather than permitting anybody to spend in anything, the SEC created an approved investor criterion.

In very general terms, unregulated protections are believed to have greater risks and greater benefits than managed financial investment vehicles. It is necessary to bear in mind that SEC policies for certified investors are made to secure investors. Uncontrolled safety and securities can provide remarkable returns, yet they likewise have the prospective to produce losses. Without oversight from economic regulatory authorities, the SEC just can't evaluate the danger and incentive of these investments, so they can't supply info to enlighten the average financier.

The concept is that financiers that make sufficient earnings or have enough wide range have the ability to take in the threat far better than investors with lower earnings or less riches. As a certified investor, you are expected to finish your very own due diligence before adding any kind of asset to your financial investment portfolio. As long as you satisfy among the adhering to four demands, you qualify as a certified capitalist: You have gained $200,000 or even more in gross earnings as an individual, every year, for the previous 2 years.

Specialist Accredited Property Investment

You and your partner have had a mixed gross earnings of $300,000 or more, yearly, for the past 2 years. And you expect this degree of revenue to proceed. You have an internet well worth of $1 million or even more, excluding the value of your main house. This implies that all your possessions minus all your debts (omitting the home you stay in) overall over $1 million.

Or all equity proprietors in the business certify as certified investors. Being an accredited financier opens up doors to investment opportunities that you can not access otherwise.

Best Investment Opportunities For Accredited Investors – Corpus Christi

Ending up being a certified investor is merely a matter of confirming that you satisfy the SEC's needs. To verify your revenue, you can provide documents like: Income tax returns for the past two years, Pay stubs for the past two years, or W2s for the past two years. To validate your internet worth, you can give your account declarations for all your assets and obligations, including: Savings and inspecting accounts, Financial investment accounts, Outstanding car loans, And realty holdings.

You can have your lawyer or CPA draft a confirmation letter, verifying that they have actually assessed your financials and that you satisfy the demands for a recognized financier. It might be more affordable to use a solution particularly developed to verify recognized financier standings, such as EarlyIQ or .

Top Accredited Investor Income Opportunities – Corpus Christi

, your accredited capitalist application will certainly be refined through VerifyInvestor.com at no cost to you. The terms angel capitalists, innovative financiers, and accredited investors are usually used reciprocally, yet there are subtle differences.

Normally, any person who is approved is thought to be a sophisticated financier. The income/net worth demands continue to be the very same for international capitalists.

Below are the finest investment possibilities for accredited investors in real estate.

Some crowdfunded property financial investments do not need accreditation, but the jobs with the best possible rewards are normally reserved for recognized investors. The difference between tasks that accept non-accredited financiers and those that just accept certified financiers normally boils down to the minimal financial investment quantity. The SEC currently restricts non-accredited financiers, that earn less than $107,000 per year) to $2,200 (or 5% of your annual revenue or internet worth, whichever is less, if that quantity is more than $2,200) of investment resources per year.

Latest Posts

How To Buy Tax Sale Property

Investing In Tax Liens And Deeds

Tax Liens And Deeds Investing